What is MyCouncil?

MyCouncil is an initiative of the Western Australian Government to strengthen local government accountability and performance.

The website provides a geographic, demographic and financial snapshot of each local government.

Data such as council expenditure by program, rates and other revenue and service delivery can be viewed for each council and compared with others.

The financial information presented in the website is provided by local governments to the Department of Local Government, Sport and Cultural Industries and the WA Local Government Grants Commission. Other supporting data is compiled from a range of sources, including the Australian Bureau of Statistics and local governments.

The most recent MyCouncil update was published in the first quarter of 2025. It is expected minor updates to fill in any data gaps will occur periodically.

Updates will be undertaken annually to populate the website with data for the next financial year. It is anticipated that 2023-24 data will be made available in 2026.

Benefits of MyCouncil

MyCouncil is a central place to access and compare information about Western Australia’s local governments.

The website is among a number of ways the State Government is helping to build the capacity of local governments and strengthen their accountability and performance.

Local government in Western Australia is a big business and growing.

MyCouncil enables access to important information to help you decide whether local governments are providing value for money.

Cost of MyCouncil

There is no additional cost to report this information. MyCouncil is populated with data obtained from local governments existing reporting requirements and via publicly available information.

Financial

Local government financial Indicator (LGFI)

The new Local Government Financial Indicator (LGFI) was developed by WA Treasury Corporation (WATC) on behalf of the Department of Local Government, Sport and Cultural Industries (DLGSC). The design was led by a steering committee consisting of DLGSC, WATC, the WA Local Government Association, LG Professionals WA, Ron Back and Associates and a representative cohort of local governments.

The LGFI has been designed to provide community members, stakeholders and the DLGSC with at-a-glance insights to local government financial performance. The LGFI is a replacement to the previously-reported Financial Health Indicator (FHI). Unlike the FHI, the LGFI does NOT attempt to assess a local government’s financial sustainability (its financial capacity to fund maintenance and asset renewal as infrastructure reaches the end of useful life).

The LGFI provides point-in-time insights to a local government’s ability to:

- meet its short term financial obligations (Liquidity);

- fund its longer term financial obligations (Solvency); and

- access funding (either internal or external) to deliver services and maintain infrastructure (Financial Flexibility).

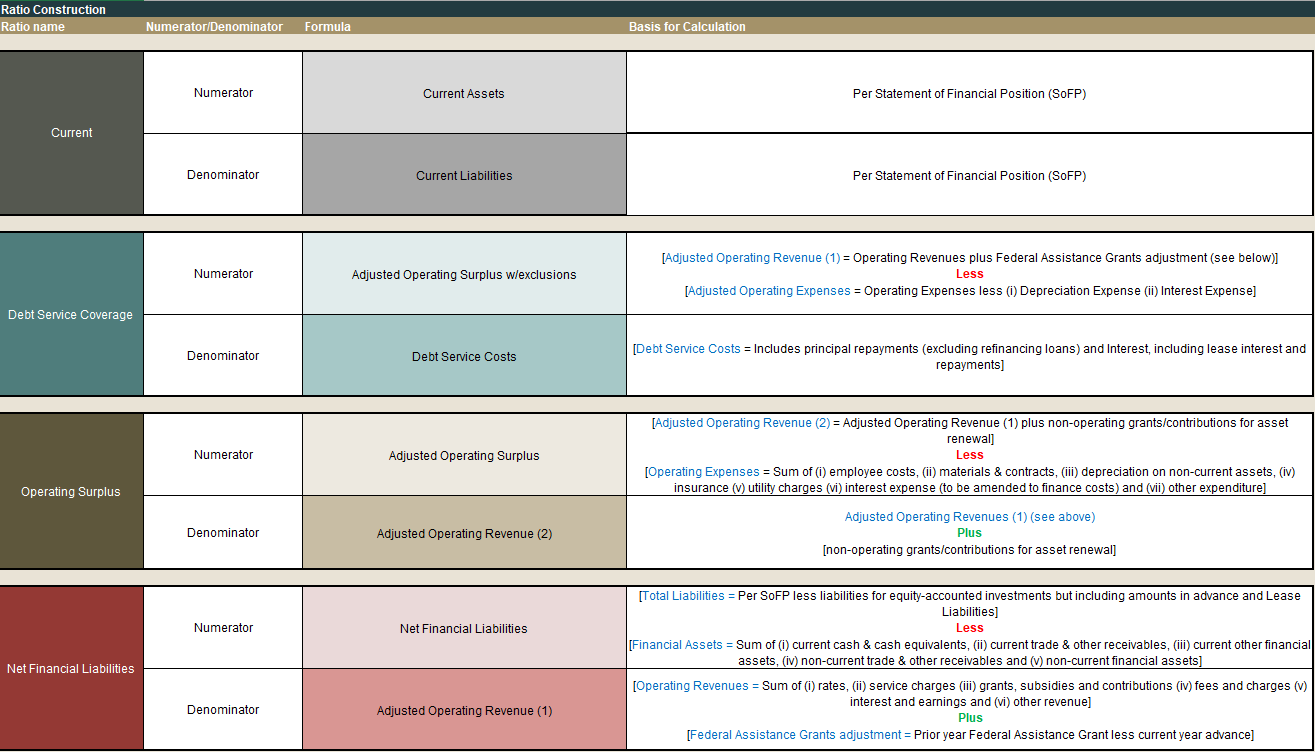

The LGFI uses the current ratio, debt service coverage ratio, operating surplus ratio and net financial liabilities ratio. The benchmark score is 70.

A very high or low ratio or LGFI may be a prompt for questions to be asked by the community about a local government’s revenue, expenses and service delivery. The MyCouncil website has provided local governments with the opportunity to provide commentary on ratio and LGFI trends, if they wish.

Ratio calculation

Comparing local government rates

There is no comparable basis for determining rates.

All local governments calculate their rates by a rate in the dollar set by each local government and multiplied by the value of land, the average rate per property, resident or type of property.

Local governments have significant autonomy in setting rates which can make comparisons difficult. They have the option of setting different rates depending on how land is used. This means local governments may levy different rates in the dollar for commercial, residential or other property uses.

Alternatively, local governments have the option of setting a flat rate for all land uses and levying additional fees for waste collection, or recovering the costs of rubbish collection through general rates.

Financial performance and perceptions of services

The LGFI is a tool to provide at-a-glance insights to local government financial performance, including liquidity, solvency and financial flexibility and does not measure the range of services a local government offers; the efficiency of services delivered; and community satisfaction.

Why local government rates rise

A local governments annual budget is informed by its Strategic Community Plan which is developed with the community. Engaging with the community enables a local government to be responsive to community needs and ensures that expenditure and prioritisation of public funds is in line with community expectations.

Local governments have a responsibility to the community to provide services that are efficient and effective.

Local governments are ultimately accountable to the public for their decisions at elections held every two years.

Contact us

More information on individual local governments can be obtained by contacting the relevant local government or reviewing their annual reports.

For issues with the webpage, queries can be referred to info@dlgsc.wa.gov.au